Forex trading practice is essential for anyone looking to succeed in the forex market. It’s a complex financial environment that requires a deep understanding of numerous factors including economic indicators, market sentiment, and global events. To excel in forex trading, traders often rely on virtual trading platforms to hone their skills without risking real money. If you’re interested in trading in the Middle East, consider checking out forex trading practice Qatar Brokers for resources and options available in that region.

Forex, or foreign exchange, involves buying and selling currencies based on their relative values. The forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Understanding the mechanics of this market is crucial for traders, whether they are novices or seasoned professionals. This article focuses on the importance of practice in forex trading and various techniques you can employ to develop your skills.

Why Practice is Important in Forex Trading

The primary reason practice is vital in forex trading is that it allows traders to develop and test their strategies without the risk of losing real money. For most beginners, the forex market can be overwhelming due to its volatility and complexity. Practicing trading strategies in a simulated environment helps to build confidence and experience.

Moreover, practice helps traders cultivate essential skills such as risk management, decision-making, and emotional control. In addition, understanding how to read price charts and market indicators becomes more intuitive with consistent practice. Traders who invest time in simulation can analyze their mistakes and make adjustments before entering live trading.

Developing a Trading Plan

Creating a robust trading plan is a vital step in mastering forex trading practice. A trading plan outlines your trading strategy, including your goals, risk tolerance, and specific criteria for entering and exiting trades. Here are the key components of an effective trading plan:

- Goals: Define what you want to achieve with your trading. Are you looking for short-term profits or long-term investment? Setting clear goals will help you stay focused.

- Risk Management: Determine how much capital you are willing to risk on each trade. A common rule is to only risk 1-2% of your trading capital on a single trade.

- Trading Strategy: Define your approach to trading. This could include technical analysis, fundamental analysis, or a combination of both. Identify the indicators and tools you will use to analyze the market.

- Review and Adjust: Regularly assess your performance. Review your trades to understand what worked and what didn’t, and adjust your plan accordingly.

Your trading plan is your blueprint for success. The more detailed and specific it is, the better equipped you will be to handle the challenges of the forex market.

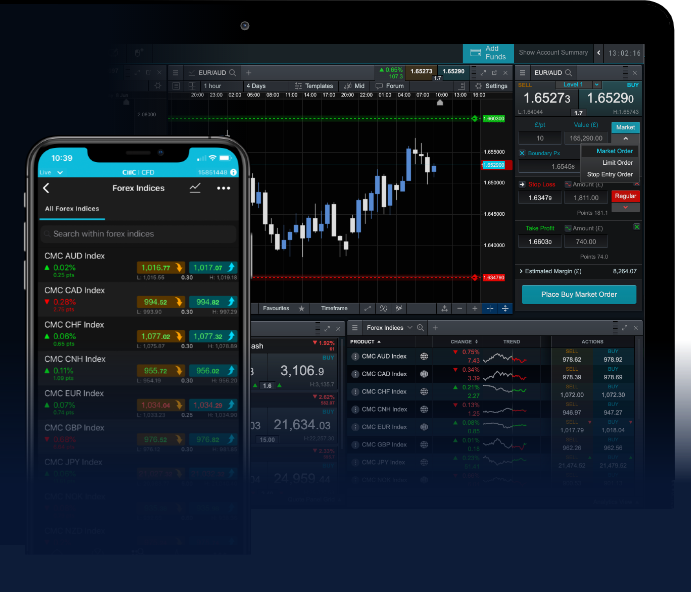

Choosing the Right Forex Trading Platform

The choice of a trading platform can also impact your practice and learning experience. It’s essential to select a platform that provides access to a variety of tools and resources, including real-time data, historical data, and educational content. Look for features like:

- User-Friendly Interface: Ensure the platform is easy to navigate, especially for beginners.

- Demo Accounts: Choose a platform that offers a demo account for practice trading.

- Sufficient Resources: Access to educational materials, webinars, and market analysis can enhance your learning.

- Customer Support: Responsive and helpful customer support can aid traders when they encounter issues.

Some popular trading platforms among forex traders include MetaTrader 4, MetaTrader 5, and TradingView. Explore different platforms to find one that suits your trading style and preferences.

Practicing with a Demo Account

A demo account is one of the most effective tools for forex trading practice. It allows you to trade with virtual money in a real-market environment. Here are some benefits of using a demo account:

- Zero Risk: You can practice trading strategies without the risk of losing real money, making it a safe space to learn.

- Familiarization: It helps you familiarize yourself with the trading platform and its features.

- Refining Strategies: Use the demo account to test different trading strategies and find what works best for you.

- Emotional Control: While trading with virtual funds, you can focus on strategy rather than being influenced by the stress of losing real money.

Understanding Market Analysis

Successful forex trading relies heavily on market analysis. There are two main types of analysis: fundamental and technical. Understanding both will give you a comprehensive view of the market.

Fundamental Analysis

This method involves evaluating the economic, social, and political factors that may influence currency values. Key elements include interest rates, inflation rates, and economic reports. By following economic news and events, traders can predict potential movements in currency prices.

Technical Analysis

Technical analysis, on the other hand, focuses on price charts and patterns to predict future movements. Traders use various indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to gauge market trends. Understanding these patterns is crucial for developing entry and exit strategies.

Cultivating Discipline and Patience

Discipline and patience are paramount in forex trading. Many traders fall into the trap of emotional trading, driven by fear or greed, which can lead to significant losses. By practicing disciplined trading habits and adhering to your trading plan, you can make more rational decisions.

Additionally, patience is key in waiting for the right trading opportunities. Successful traders understand that not every moment is ideal for trading. It’s about waiting for the perfect setup rather than forcing trades.

Continual Learning and Adaptation

The forex market is dynamic, constantly influenced by geopolitical events and economic changes. Therefore, continual learning is vital. Invest time in educating yourself through books, webinars, online courses, and forums. Engaging with other traders can also offer fresh insights and strategies.

Moreover, as you gain experience, be open to adapting your methods based on market conditions and your evolving understanding of forex trading. Flexibility in strategy can often separate successful traders from those who struggle.

Conclusion

In conclusion, mastering forex trading practice requires dedication and effort. By establishing a rigorous practice routine, developing a solid trading plan, and utilizing the right tools, you can greatly enhance your trading skills. Remember, every experienced trader was once a beginner; the key is to embrace the learning journey and stay committed to your goals.