There’s a $10,000 minimum deposit requirement to open a CD account. CDs can be a low-effort, lower-risk addition to your investment strategy, which can help balance out risker investments. But investing in CDs also means you may miss out on better profits elsewhere, as rates vary widely across institutions, both brick-and-mortar and online. Like any investment, Carefully review your CD options before settling on one.

What are key similarities and differences between a money market fund vs. a CD?

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Rather than rely on a single account for all of your savings, consider opening separate money market accounts for specific savings invest in cds or money market goals, such as emergencies, travel and a home down payment. If you struggle to keep from spending your savings account, then a CD could be a good choice. Plus, there’s no worry about losing money, unlike investing in stocks or other types of nonguaranteed investments.

Liquidity in Money Market Accounts

The fixed interest rate can also be a drawback if inflation rises significantly during your CD’s term. In such a case, the purchasing power of your returns might be less than expected. Once you invest in a CD, your money is tied up for the duration of its term. If you need to withdraw your money early, you’ll likely face a penalty. Liquid CDs provide more flexibility by allowing you to withdraw part of your deposit without penalties. However, they often require a larger initial deposit and offer lower interest rates.

Quontic Bank

- Compare the rates and terms of the best money market accounts to those of the best high-yield savings accounts to find the right place to grow your money.

- A high-yield savings account is best if you simply want a savings account but with a higher APY.

- While the rates paid by savings accounts, CDs and money market accounts are not tied directly to this rate, they are influenced by its changes.

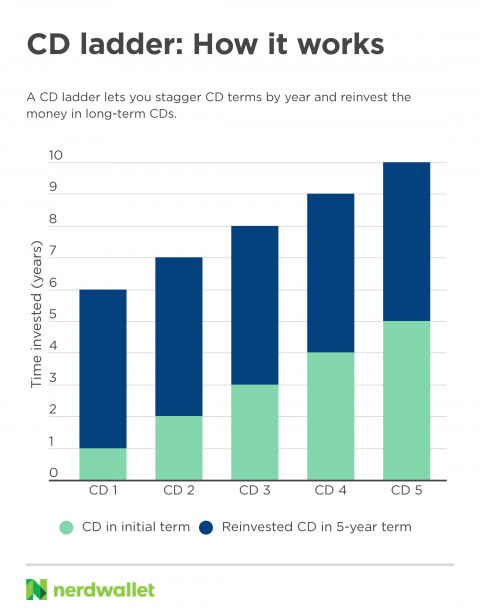

- When the each CD matures, you can decide to either withdraw the money or roll it into a new CD.

- One way to do so is by deciding which savings account is the right fit for you.

Unlike with traditional savings accounts, funds stored in your CD aren’t meant to be withdrawn for a prespecified amount of time. But as you evaluate money markets vs. CDs, there are a variety of factors to consider before making a selection. Most financial institutions offer money market accounts as a higher-yield alternative to traditional savings accounts.

The following reasons might lead you to choose this savings option over a CD. Though money market accounts and CDs are both good options to increase the earnings on your savings, there are some key differences to be aware of. CDs may offer higher yields than MMAs, although this depends on the issuing bank. If you won’t need the money, you could look for the best rate with the longest term, and lock that in.

Understanding Money Market Accounts

In some cases, CDs may be purchased on the secondary market at a price that reflects a premium to their principal value. CD rates fluctuate, so it’s recommended to regularly survey the market, especially online banks, to find attractive APYs. Pacaso cannot provide specific tax or investment advice, and you may want to consult with a tax advisor regarding this investment. Generally speaking, equity investors are required to report income on their tax return if they have realized a gain or loss on their investment.

Quontic Bank offers traditional CDs with term lengths ranging from six months to five years, and you can earn up to 4.95% APY. Its CDs have a $500 minimum deposit requirement and no monthly maintenance fees. Ally Bank offers High Yield CDs, Raise Your Rate CDs (get a higher rate when rates increase), No Penalty CDs (withdraw penalty-free) and IRA CDs (save for retirement). CD term lengths range from three months to five years, and you can earn up to 4.30% APY.

Kalsman generally holds off on recommending 10-year CDs and says she doesn’t see other financial advisors endorsing them, either. Not many banks even offer CDs with 10-year terms — the few that do include Discover®, Vio Bank, EmigrantDirect and MySavingsDirect. Longer-term CDs also have less liquidity since savers are typically subject to penalties if they withdraw before the maturity date. When you look at longer-term CDs, however, putting your money in the market may make more sense. He has written for regional banks, fintechs, and major financial services companies.